Big difference between a pension and a 401(k)

Thinking about retirement? For many Californians, that day will never come. They work hard their whole lives, but never have the means to finally stop worrying, put their feet up and relax.

A good pension, that golden reward for a lifetime of service, is an endangered species as employers shift the burden of planning onto employees. But when you’re living paycheck to paycheck, it’s hard to put money aside for anything – including retirement.

Social Security is an important safety net that helps millions of Americans live out their years with some dignity and peace of mind, but it’s not enough on its own. What if you’re denied the opportunity to even participate?

Meet Robert. He’s an SEIU member who currently serves as a home care provider.

“I’ve worked hard my whole life,” Robert said. “I worked in refineries, worked for the Conservation Corps, and started pursuing a business degree to better my life, and provide for my family.”

That all changed with the birth of his son, Amorrie.

“I spend my days caring for him,” Robert explained. “He has been on a ventilator with a feeding tube practically all of his life.

“I love my son and he is a blessing in my life,” he continued. “But as a family home care provider, I don’t qualify for any form of retirement – not even Social Security. Like so many others living paycheck to paycheck, I’m left without a safety net. Who will take care of me in retirement? I’ll be exactly where I am now in 20 years, working full time and struggling to get by.”

Typically people talk about retirement security as a three-legged stool – Social Security, pensions and individual savings. For people like Robert, it’s more like balancing on a pogo stick as he wends his way down the road towards retirement.

And consider this: Half of all Californians working today have no access to a retirement plan through their employers.

Robert is not alone in this situation. Many seniors never retire; they can’t afford it.

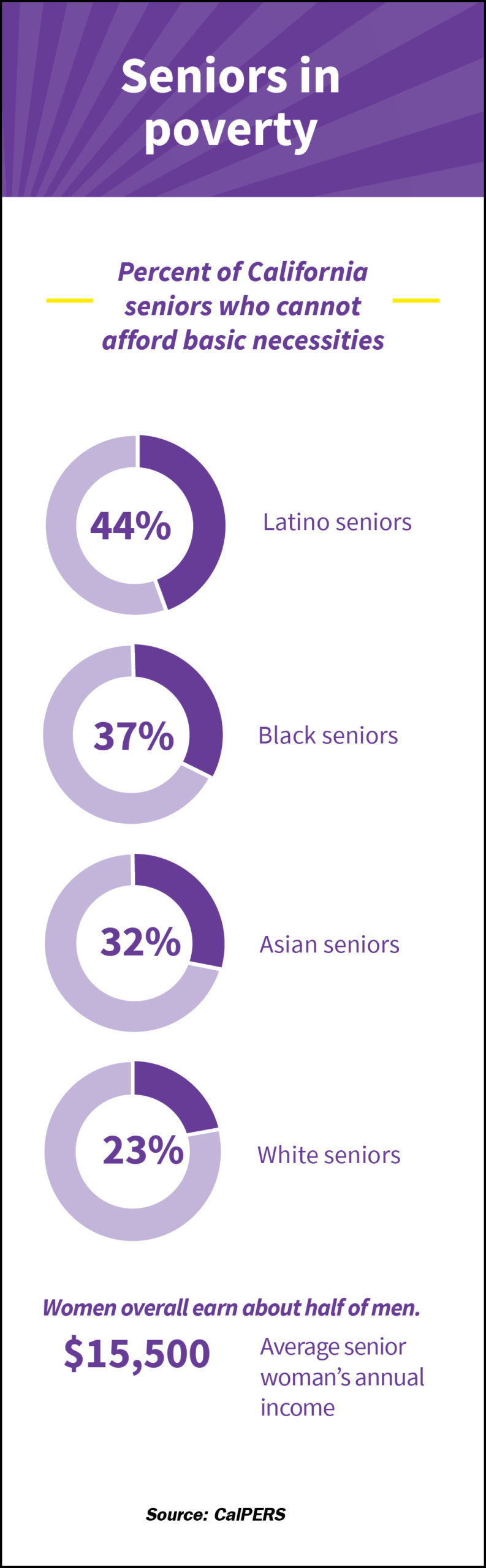

One in four California seniors lacks income to meet basic needs. In particular, women and seniors of color feel the effects of our broken system even more. That’s because they tend to earn less while working, and get fewer benefits when they stop.

To end poverty, we need to help bolster retirement programs and preserve pensions. Less than a third of Americans now qualify for a pension program. Yet, pensions are an important anti-poverty tool.

And contrary to myths, employees contribute mightily to their pensions; public employees on average kick in 12% of their salaries towards their pensions. The average pension is $2,945 a month in California, or about $35,340 a year.

As future retirees, we have to understand the big difference between a “defined benefit plan” and a “defined contribution plan.” They are by no means equal ways to guarantee a comfortable retirement.

That’s why protecting pensions is so important to those of us who may still have one. That also is why I helped pass a law in California requiring employers to offer a plan for their workers. And why I helped create a plan for private sector workers called CalSavers. It offers low-wage workers a way to save for retirement with low fees and the benefit of professional management, with a public oversight board of which I am a member.

We are still adamant about increasing wages and controlling skyrocketing housing coasts. Our seniors’ insecurity represents the sum of decades of bad decisions by employers, politicians and developers. No one should live on $15,000 a year in California at the end of decades of work and have to work until they die.

What’s the difference?

A defined benefit, such as a pension, is a promise. Under a defined benefit plan, an employee knows for sure that he or she will receive in retirement a certain amount of money. Investment risks are shared by the employer and spread across a giant pool.

By contrast, a defined contribution plan, such as a 401 (k), has no guarantees. What’s defined is how much the employee pays into the plan each month. That money is then invested. The plan’s potential benefits depend on the market. The employee carries all the risk. In addition, the employee pays hidden fees to Wall Street – which can really add up. When the employee is ready to retire, there may be no benefits at all.

president,

SEIU Local 1000

PHOTO COURTESY OF SEIU local 1000

Be the first to comment on "Yvonne R. Walker: Retirement security for all"