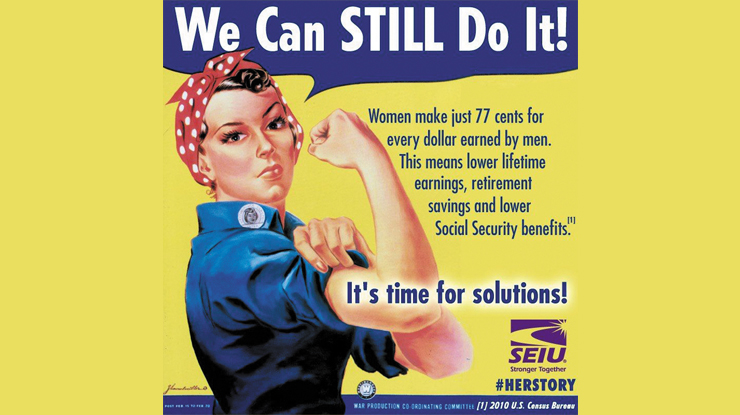

High earners should pitch in fair share to Social Security

How do you feel about your retirement prospects? Are you optimistic that you’ll be able to afford to stop working some day?

If you’re anxious just thinking about this subject, you’re not alone.

Last week, I wrote about the problems with our retirement system on a policy level. What strikes me about this issue is that more and more people are deeply concerned about retiring without security of any kind.

Will you have enough money to live comfortably in retirement? Almost half of Americans say no. That anxiety keeps growing. Back in 2002 when Gallup first asked that question, only one in three Americans expressed doubts about their retirement savings.

This makes sense. In 2002, many more people had pensions, and Social Security wasn’t under continuous attack.

Now in California, one out of every two workers has nothing saved for retirement. Nationally, the numbers are no better. On average, older workers age 56 to 61 – very close to traditional retirement age – have $17,000 saved for retirement.

Counting on Social Security alone? The average monthly payment in California is $1,377 – less than the average rent for an apartment.

We see people in their 80s, looking for work because they need the money. We know people who live on Social Security alone, with no consistent transportation, no way to afford regular dental or vision care, no way to visit loved ones.

This is no way to end one’s working years.

These statistics reflect the difficult situation so many working Californians face. Take Pablo Narvaez. Now in his 50s, he has been working in the fast food industry for almost two decades, and is always holding two or three jobs to make ends meet.

When I met him, he was working in the morning in construction and in the evening in a restaurant. He had just finished sending his children to college and was going to start – at age 52 – to try to put some money away for retirement. Besides that, he’s worried about continuing to work. Pablo shared that, as he gets older, he has fewer opportunities to be hired or to get a full-time job.

We are fighting back against federal attacks on retirement that would make our retirement even riskier. The Koch brothers and other billionaires have spent millions trying to privatize Social Security, the best anti-poverty tool for seniors. Although these opponents have yet to gut this safety net, they have been successful in making more people believe Social Security is in trouble.

The real problem with Social Security is high earners are not paying their fair share. Currently, people pay Social Security taxes on their income up to $132,900. Any income above that amount is not taxed. By removing that cap, billions more every year would go towards ensuring Social Security’s future benefits.

That would be a popular move. A 2017 Pew Research Center poll found that 95% of Democrats and 86% of Republicans preferred to maintain or expand Social Security.

We don’t have a resource problem, we have a distribution problem. If more wealthy people pay their fair share, we will have plenty of money in the Social Security Trust Fund for our lifetimes. And we could look ahead to a future where our senior years are indeed golden.

President,

SEIU Local 1000

PHOTO COURTESY OF SEIU local 1000

Be the first to comment on "Yvonne R. Walker: Worried about your retirement? You are not alone"