Women particularly face challenges in golden years

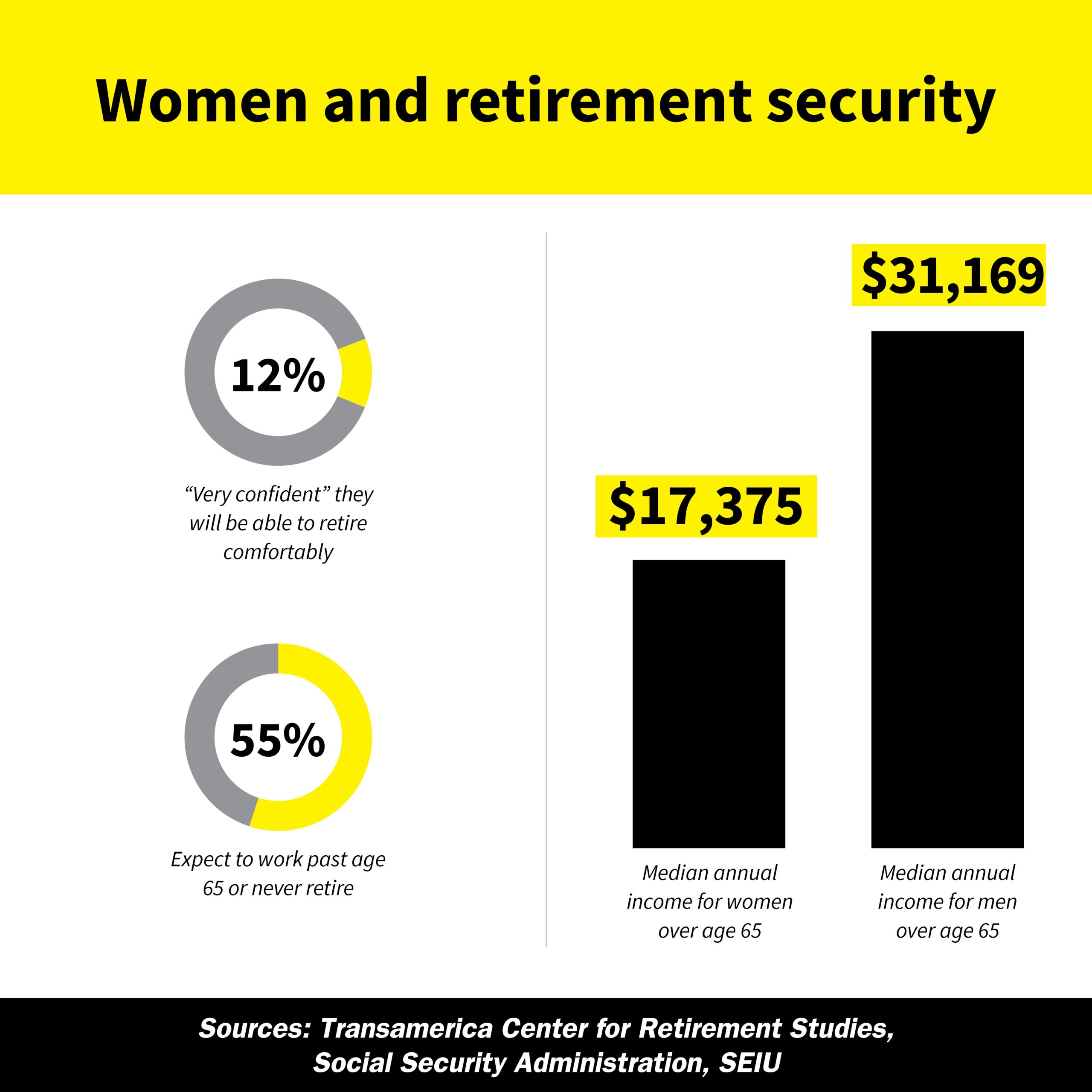

Are you dreaming of a happy retirement? For women, prospects for their golden years can appear pretty bleak as we are more likely to be poor in retirement than men. It’s no wonder given the fact that we begin and end our careers being paid less than men for the same work. Due to raising families and caring for loved ones (often unpaid), we also have fewer hours in the labor force. Meanwhile, Social Security — what many Californians rely on for their retirement income — as well as pensions are based on earnings and time worked.

Adding to the financial strain, women are more likely to be single as seniors and live longer, meaning we have to make our limited resources stretch that much farther … and often end up homeless or dependent on relatives or strangers for support.

But the plight of poverty is a major problem for all seniors in California, where about half of all workers have no access to a workplace retirement plan.

In response to that, we worked with the state to create CalSavers, a retirement plan for mostly low-wage workers who have no employer-based savings plan such as a pension or 401(k).

To support the development of CalSavers, we invited a brave and inspirational woman to share her story: Sally Armendariz. As a younger woman, she made legal history by challenging the law that prohibited women from getting disability payments for pregnancy-related conditions that kept them from working. Decades later, Sally’s employer fired her after 38 years; a paralegal, she had requested time off because her husband had died. She lost her husband and her job on the same day. So, at 76 and with no retirement options, Sally was still working. But she continues to proudly speak out for the need for such safety nets as CalSavers.

What does senior poverty look like? People have to make daily choices between buying medicine or food, between filling a prescription or paying a utility bill. It’s no surprise local food banks and homeless shelters say they’re seeing the biggest client growth among seniors.

When I go to a grocery store or to a restaurant, I often silently reflect on how old the age of the various employees I encounter may be. The gray-haired cashier or the senior hostess who showed me to a seat have to be on their feet all day for most of their shifts.

SEIU Local 1000 fights for pensions for public sector workers. In California, the average monthly pension is $3,084 or about $36,000 annually. We still need to combine Social Security benefits with pensions and personal savings for our members to enjoy a secure and dignified retirement. However, for as many as one-third of CalPERS retirees, they do not receive Social Security and are dependent on their pensions and savings alone.

Another group SEIU represents faces even greater challenges: Home care workers. These workers often care for family members with a disability. If you care for a family member, you are not eligible to contribute to Social Security. Unless they care for others, the worker has absolutely no retirement security. That’s why our sister local SEIU 2015 fights for decent wages, health care, unemployment and retirement security for home care providers.

What’s past is prologue; we’re all going to face this issue at some point. Working together now, we can help make all Californians’ prospects for a comfortable retirement a reality.

President,

SEIU Local 1000

PHOTO COURTESY OF SEIU local 1000

Be the first to comment on "Yvonne R. Walker: Secure retirement needs more than dreams"